Frequently asked questions

Some frequently asked questions about KiwiSaver Schemes

Read ArticleTop KiwiSaver Scheme Articles

Frequently asked questions

Some frequently asked questions about KiwiSaver Schemes

Planning your future retirement lifestyle

Retirement means different things to different people, but whatever your ideal lifestyle looks like, one thing is certain: achieving it requires a fair share of planning and foresight. So, here’s a quick guide to get you started.

Is it ever too early to talk about money?

Financial education starts at home, and it begins with developing good savings habits. The sooner kids grasp the basics of personal finance and investing, the better equipped they may be to make informed decisions as they grow older. So, why not start today?

More Articles

Top tips for homebuyers 2025

If you’re entering the property market, it’s essential to equip yourself with the right knowledge. With a solid understanding of your financial situation, mortgage options, and key property considerations, you can make informed decisions.

Mortgage goals for homeowners in 2025

Is this the year you take control of your home loan? If you have a mortgage, there are key three things you can do this year that will really make a difference to your financial life, now and into the future.

Mindful spending: Enhancing financial habits for better mental wellbeing

Learning to incorporate mindful spending can create a healthier relationship with money and in turn, foster mental resilience.

Building emergency funds and the role of income protection

Life can be unpredictable, which is why it’s so important to be prepared for unexpected challenges. Building an emergency fund and having income protection cover are two key strategies that can provide you and your loved ones with a financial safety net.

Adviser vs bank: What’s the difference?

So you want a home loan. Are you better to go straight to your bank, or to ask a mortgage adviser to help? Here’s how working with a mortgage adviser can be different from dealing with a lender directly.

Buying a home? Here are some helpful tips

Buying a house can be an exciting time. But if you’re just beginning the process, you might be wondering where to start. Here are ten tips to make your home-buying journey a bit smoother.

What is a mortgage?

Mortgage rates are frequently discussed in the media, and mortgage advisers around the country (such as the team at LifeDirect Mortgages!) help borrowers find a suitable mortgage fit every day. But what is a mortgage, anyway? Find out here.

What is a mortgage adviser

If you’re thinking about buying your first home, or moving into a new one, you have probably thought a bit about your home loan. But have you thought about how a mortgage adviser can help? Here’s what you need to know about mortgage advisers, and what they can do for you.

Your KiwiSaver questions answered

How well do you know KiwiSaver? And have you got your settings right for your circumstances? Here are some common questions answered

Tips to managing stress

Like to reduce stress and boost your wellbeing? Here are some practical tips that can serve as building blocks for a healthier you.

Make the most of all your health insurance benefits

Are you getting maximum value from your health insurance? Here’s why it might be worth looking into what extra benefits are available

Debunking common insurance misconceptions

There are a number of common myths and misconceptions about insurance – and believing them can sometimes mean people miss out on vital, valuable protection.

Understanding the different types of insurance

When it comes to personal risk cover, there are a lot of options. Here is what you need to know about life, health, trauma and income protection options.

KiwiSaver: Teaching kids about investing

Retirement, or even buying a house, probably isn’t top-of-mind for most kids. But that doesn’t mean KiwiSaver isn’t a useful tool for them. Here are a few things to think about.

Staying fit in winter

It's that time of year again - winter is rolling in. While we might not have snow to contend with, staying active and healthy can feel like a bit of a mission when temperatures drop. But fear not, we've got some practical tips to help you stay active and fit through the colder months!

Health insurance for families

When it comes to health insurance, there are reasons why it might make sense to have cover as a family group. Here’s what you might need to know.

Common health insurance terms and what they mean

Having a good understanding of some of the most common terms can make it easier to get the most out of your policy, and to know what to expect when it comes time to claim.

Health insurance and winter wellness

There are health insurance options that can help you access healthcare for many of the more minor winter ills that can plague us through the winter months.

How to assess your KiwiSaver fund performance

Here is a quick rundown of the sort of things to think about, and what you can do to help your fund grow towards your goals.

Fun ways to explore, adventure, and stay active

Here are some fun ways to explore, adventure, and stay active while immersing yourself in the beauty of Aotearoa.

Why personal insurance is essential for financial security

Personal insurance cover acts as a safety net, making sure that you can achieve the financial goals that you set yourself – and that you can’t be knocked off course financially by something unexpected. Here is a rundown of the things you might need to know.

Five key benefits of having health insurance

Have you really thought about all the benefits of having health insurance? Here are five key ones.

Understanding the role of underwriting in life insurance

In the world of life insurance, there’s an important process that often remains behind the scenes, called underwriting. Understanding the role of underwriting is essential for both insurers and policyholders. So, let’s explore this key aspect of life insurance.

Adviser Corner: Factors to consider when choosing income protection insurance

To talk about income protection insurance and the significant benefits this type of insurance can offer, we spoke with our senior insurance adviser, Tony McCombs.

Create financial security as a single-income family

Whether you’re in that situation for the short-term, or likely to be single-income for some time, there are a few things you can think about to boost your financial security.

Why your income is one of your most valuable assets

Are you underestimating the power of your income? Find out why your income is one of your most valuable assets.

KiwiSaver withdrawals: When and how to access your KiwiSaver

Often, when we talk about KiwiSaver, we focus on the accumulation side of the story. But what happens when you start to think about taking money out? Here is a rundown of how withdrawals from KiwiSaver can work.

Riding the ups and downs of budgeting

While budgets sometimes get a bad name, a well-managed budget can be a hugely powerful tool to get you to your financial goals – and allow you some fun along the way. Here are a few things to think about.

Are you on track to save enough in KiwiSaver?

Are you on track to save enough money in your KiwiSaver account? Here are a few things to check.

How much KiwiSaver risk should you take?

Often, when we talk about “risk”, there’s a negative connotation. The key is to make sure you’re taking an appropriate level of risk for your personal circumstances. Here’s what you need to know.

LifeDirect: Easily quote, compare, and take out insurance in one place

In the vast landscape of insurance options, finding the right cover can sometimes feel like a daunting task. From health insurance to life insurance, the array of policies available can understandably overwhelm any of us. That’s where LifeDirect steps in, providing not just insurance comparisons, but also a straightforward way to purchase insurance direct.

How much cardio do you need to do to boost your heart health?

We all know moving more is good for us. It can reduce stress, produce endorphins, and boost cardiovascular health and fitness. But how much do you really need to be doing each week to improve your heart health?

What happens to insurance when you have an unexpected health event?

Here are a few things to think about if you’ve ever experienced an unexpected health event.

What lifestyle and physical factors might affect your insurance premiums?

What if you’re looking at insurance when you’re not quite so young or not as healthy as you could be? Here’s how a few lifestyle and physical factors might affect your insurance cover.

How to proactively manage your KiwiSaver investment

Here are a few things to put on your checklist, to turbocharge your KiwiSaver investment.

When is a higher KiwiSaver contribution rate a good idea?

If you’re wondering whether to stick with the default 3% contribution rate or opt for a higher rate, here are some important things to consider.

How your phone can help you get fit

Have you thought about using your smartphone to get fit? Here are five ways it can help you.

Discover the Extra benefits of Your Insurance

Beyond financially protecting against life's uncertainties, many insurance policies also offer a variety of additional benefits designed to support your health and overall well-being — such as: discounted gym memberships or free periodic health screenings.

How to get your health insurance sorted

Here are five things you can do now to work out whether your health insurance is giving you the protection you need.

New year, new you: Aligning your goals with health insurance

As we step into the new year, many of us are setting health goals, seeking to improve our well-being. But how can health insurance fit into this renewed focus on health?

The benefits of a digital detox

What better opportunity than the holiday break to consider a digital detox? As our lives are increasingly infused with technology, here’s how taking a break from your devices can bring transformative benefits for your overall well-being.

KiwiSaver fees matter (but they’re not the only thing)

When it comes to choosing your KiwiSaver provider, fees are one of the key factors to consider. Why? Because costs matter: as small as they might be, they can significantly affect your final balance over time.

Crafting the perfect NZ summer picnic

Ah, the Kiwi summer – the warm breeze, the endless coastline, and the lush parks call us outdoors. And what better way to revel in the warm season than with a picnic? Here are some expert tips to craft the ultimate New Zealand summer picnic.

Vacationing away? How to protect your home while you’re gone

As the festive season beckons, you may be heading out for a well-deserved vacation. Whether it’s a road trip around New Zealand, a visit to family, or a longer adventure overseas, here’s how to keep your home safe in the meantime.

Pre-New Year detox: Tips to reset before the year ends

After another intense year, we’re probably all looking forward to pausing and rejuvenating this festive season. So, here are some holistic detoxing tips from the experts, to help you reset before ringing in 2024.

Adviser Corner: Ideas and inspiration for a bright 2024

Can you believe another year is ending? From all corners of LifeDirect, we’ve gathered some tidbits and tips to share with you. Just some good food for thought as we gear up for 2024.

Is it ever too early to talk about money?

Financial education starts at home, and it begins with developing good savings habits. The sooner kids grasp the basics of personal finance and investing, the better equipped they may be to make informed decisions as they grow older. So, why not start today?

Planning your future retirement lifestyle

Retirement means different things to different people, but whatever your ideal lifestyle looks like, one thing is certain: achieving it requires a fair share of planning and foresight. So, here’s a quick guide to get you started.

Frequently asked questions

Some frequently asked questions about KiwiSaver Schemes

LifeDirect’s year in review: What was new in 2023

As another intense year draws to a close, we took a moment to take stock of 2023. From tech advancements to community partnerships, let’s take a quick stroll down memory lane. This year…

Why your brain doesn’t like change (and how to outsmart it)

Here are some expert tips to help you maintain emotional and financial well-being while dealing with life transitions.

Strengthening your financial resilience in uncertain times

In a world where interest rates and the cost of living are as unpredictable as tomorrow’s weather, how can you prepare for the unexpected? By building financial resilience, brick by brick. Here are some key things to think about.

How life’s big moments can affect your insurance needs

Did you say “I do” this year? Maybe you welcomed a new bundle of joy, or got the keys to your first home? Here’s why these and other life events can prompt a serious look at your insurance policies.

Little one in the family? Protect their future, today.

Ensuring that your family is protected from life’s what-ifs. That’s where getting the right insurance cover comes in, giving you invaluable peace of mind.

Why your income is your most important asset

If you were asked to name your most valuable asset, what would you choose? Your ability to earn throughout your life is a huge asset. Read on to learn more.

Planning for a career change

Have you been thinking about a career change? If you’re pondering a shift, whether it’s to a completely different industry or just within your current sector, there are a few things you can think about.

Top tips for better work-life balance

Do you ever feel like work is starting to take over your life? Between messages on your phone in the evenings and emails that arrive over the weekend, it can sometimes feel like it’s hard to get any time off. Here are four ways you can boost your work-life balance.

Protecting your income: do you have a plan B?

Life is unpredictable, and unexpected turns – like accidents or serious illnesses – could impact your ability to work and earn a living. Do you have a plan B for those circumstances?

Frequently asked questions

Some frequently asked questions about pet insurance

Frequently asked questions

Some frequently asked questions about car insurance

Here’s how insurance is changing for the future

If you think about personal insurance simply as something that steps in when something bad happens, it might be time to think again. Insurance is changing, offering new opportunities for those who use it.

How our quote compare tool works

Looking for personal insurance? You’ve come to the right place. Every day, many Kiwis use our quote compare tool to quickly research their options and – if they find what they’re looking for – apply for cover. So, if you’d like to make the most of this tool, read on. We’ll tell you how it all works.

Smartphone apps to boost your wellbeing

Help might be available in the palm of your hand. There are smartphone apps available that offer to help with everything from exercise to meal tracking, meditation to sleep. Here are eight free apps that could boost your health and wellness journey.

Choosing insurance: talk to an adviser or DIY?

In our tech-savvy world, you might think AI has the upper hand. We have Alexa ordering our groceries, Siri giving us driving directions, and chatbots handling customer inquiries. But when it comes to sorting out insurance matters, we find that a lot of people still want to have a good old chinwag with a fellow human.

Frequently asked questions

Some frequently asked questions about house and contents insurance

The essential questions for your LifeDirect adviser

To help you kickstart the conversation, we asked our LifeDirect advisers for some key questions to ask them. Or, if you prefer DIYing and sticking to our quote compare tool instead, you can use these questions as a handy checklist.

The health benefits of social connection

There is a well-known quote: “No man is an island.” While John Donne might have uttered those words more than 400 years ago, the idea behind them – that our connection to other people is important for our survival – remains as true as ever. And turns out that there are very real physical and psychological benefits to building strong social connections, even in the modern era of digital connectivity. Here are just a few of them.

Creative ways to show appreciation to your friends

Great friends are a wonderful thing to have. So, with International Friendship Day (30 July) upon us, why not show them how much you appreciate them? Here are a few ways that you can show appreciation to your friends, no matter your budget.

How to talk with friends about insurance

When you think about the things you talk to your friends about, insurance probably isn’t top of the list. It might seem a bit dry, and it’s something that most people hope they’ll never actually need to use, anyway.

Frequently asked questions

Some frequently asked questions about business cover

Why is insurance important for business?

Own a business? You’ve poured your heart, soul, and countless cups of coffee into building your creation. And all your goals and dreams are worth protecting. So, here’s how and why business insurance can come in.

What is public liability insurance?

As a business owner, you may have heard of public liability before. But what does it entail exactly and – most importantly – do you need it? In this quick guide, our friends at BizCover dive into these essential questions.

What is professional indemnity insurance?

Does your business offer advice or professional services? No matter how prepared and careful you are, the risk of a misstep is ever-present. And that’s where professional indemnity insurance can step in.

What type of business insurance do I need?

Thinking about protecting your business? When it comes to insurance, the key thing to remember is that no two businesses are the same. That means what’s right for a cosy café is unlikely to be the best fit for an accounting firm – because different industries face different risks.

LifeDirect advisers share their health journeys

In our Adviser Corner articles, we often speak about how to protect your financial future, but what about our personal health and wellbeing? Of course, our friendly advisers are not fitness coaches, but they have learned a thing or two in their own journeys towards a healthier lifestyle. So, this month, we asked them to share their stories.

What do fitness and financial wellbeing have in common?

They are two key factors that can make a really big difference to your overall wellbeing – reducing stress, boosting your enjoyment of life and extending the range of things you’re able to do, no matter your age. Here are a few other similarities between the two.

Seven fitness challenges for a healthier, happier you

In recent years, there has been an explosion of online training programmes, which give you access to some of the best the fitness world has to offer, sometimes in the comfort of your own home. Here are seven fitness challenges worth exploring for the next step in your fitness journey.

The benefits of health insurance for active Kiwi

Health insurance isn’t just important for people who have health conditions that require treatment. There are many reasons why people who are generally fit and healthy should consider taking health cover. Consider these benefits as a great bonus.

Is it time to boost your financial knowhow?

Good news, there's now a wide range of tools available, designed to help boost your financial literacy. Here are some of the options.

How to help your kids be great with money

Like to give your kids the best start possible in life? A big part of that is helping them to understand how the financial world works, so that they are confident with money when they head out into the world. But where can you start? Here are a few ideas.

How financial literacy boosts wellbeing

People who are financially literate often have many advantages. They may be able to make better investing decisions, which can lead to better outcomes in the long run or avoid debt traps. But being financially literate isn’t just a good thing for your bank account. It can also make a big difference to your overall wellbeing. Here are a few of the ways that boosting your financial literacy can leave you better off in a more holistic sense.

Choosing the right insurance cover

True peace-of-mind can be priceless, and having the right insurance cover in place can give it to you. Insurance can take away financial stresses and worries, from whether your family will be looked after when you die to helping you fund private healthcare, should it be necessary. But how do you know what you need, and which policies might be appropriate?

Five reasons to get income protection insurance

When it comes to preserving your financial wellbeing, income protection insurance can be a powerful tool, as it provides a regular income stream if you’re unable to work after the period of time specified in your policy, due to illness or injury.

Keeping cover and managing costs in pricey times

With the increasing cost of living, it's natural to look for ways to reduce your expenses. But when it comes to reviewing your insurance, it’s important to remember that it’s not just a cost: it’s a valuable tool to create financial resilience.

Some creative ways to boost your income

Is the rising cost of living making it challenging to achieve your financial goals? You may be looking for creating ways to boost your income (that don’t involve asking for a pay rise or taking on a second job).

Affordability and insurance: how getting advice helps

At LifeDirect, we’re committed to helping Kiwis find appropriate insurance coverage for their needs, and affordability plays a key role in the process. We recently sat down with insurance adviser Laura Lincoln to discuss common misconceptions around insurance costs and how LifeDirect can help clients find (and keep) affordable cover.

How we help Kiwi families protect their future

Here at LifeDirect, we’re all about helping Kiwi families protect their financial well-being, now and over time. So, we asked our friendly insurance adviser Ben Laurenson to tell us a bit more about frequently asked questions, common misconceptions and more.

Fascinating facts about women’s bodies

Did you hear the one about how women are from Venus and men are from Mars? Well, it turns out there might be something to that. Here are some fascinating facts about women’s bodies you probably didn’t know.

Nine essential health checks for women

As the saying goes, ‘prevention is the best medicine’, and advances in medical technology are making a huge difference to people’s lives. If you’re a woman, here’s a handy list of checks and screenings to help you keep your health in tip-top shape.

It’s time to close the insurance gender gap

Are you a woman exploring your insurance options, or simply would like to make the most of your financial protection? Here are some key things that women need to know about it. But first, some sobering stats…

What is total and permanent disablement (TPD) cover?

Imagine a scenario where sickness or injury has left you permanently unable to work. It's not a pleasant thought, but unfortunately, it's a possibility. However, there's a way to protect your family from the potential financial impact of this unfortunate circumstance - Total Permanent Disablement (TPD) cover.

What is accidental death insurance?

While we can't always prevent these unforeseen events from occurring, we can take steps to protect our families from the financial impact they may have. And one way to do this is by getting accidental death insurance.

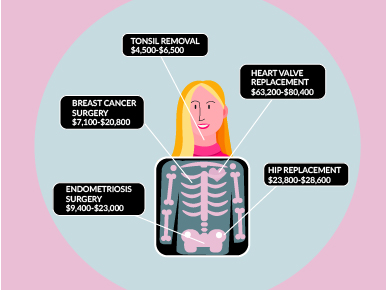

How much do common surgeries cost?

Have you ever wondered about the real cost of healthcare in New Zealand? It may come as a surprise, but even small medical procedures can add up to thousands of dollars.

Four things about pre-existing conditions and health insurance

How may a pre-existing medical condition affect your health insurance cover? Short answer, “it depends” - on the condition, on the policy, and on the insurer. But here’s the good news: pre-existing conditions aren’t always ‘uncoverable’.

Health findings that may improve your life

The human body and mind are a source of wonder. With every study, researchers learn something new about how the brain works and what makes our body run.

One question to test your financial resilience

How long could you cope financially if you stopped receiving your income? A year, six months – a few weeks? The answer to this question is revealing.

We can help you achieve those New Year’s resolutions

Still in that ‘new year, new you’ mood? Here at LifeDirect, we’re all about new beginnings and fresh starts. And when it comes to those elusive New Year’s resolutions, we’re in your corner.

Six strategies to make your New Year’s resolutions stick

Ever wondered why New Year’s resolutions don’t seem to stick? Take heart – research shows it has little to do with a lack of willpower, and more to do with a lack of plan.

How insurance protects families of all shapes and sizes

Whether you’re a single parent, a stay-at-home parent, or a new parent, there are many good reasons to welcome insurance to the family. Here’s how insurance can help protect you and your loved ones, depending on your household’s shape and size.

Five things we love about a Kiwi summer

Ah, summer – the season of beach trips and endless BBQ parties, with jandals as the only pair of shoes. There’s so much to love about a Kiwi summer, but let us tell you what our team love most (just in case you’re looking for inspiration!).

What people ask us most about life insurance

This month we ask our friendly insurance adviser Amy Webster to tell us a bit about life insurance - as well as some frequently asked questions.

Five ways being kind is good for your health

Being kind to yourself and others is so important - and beneficial for your health

Tony's tips for making the most of your insurance

We're having a chat with our senior insurance adviser Tony for his tips on making the most of your insurance.

It's Movember! Key health checks all men should schedule

She'll be right, until she won't - Highlighting an important conversation

Do renters need personal insurance?

Many people seem to think that getting personal insurance is only for homeowners, but it can have some great benefits for renters as well.

Do you know who owns your life insurance policy?

Ownership of your life insurance policy is important - and often overlooked.

Are you drinking enough water?

Are you drinking enough water? Many Kiwis are not, here we have some great tips and insight for staying hydated.

Five steps to a more sustainable life

With no planet B to turn to, many people are looking for ways to reduce their carbon footprint and their impact on the environment - and why not, maybe even save some money in the process. Sound like you? Check out these expert tips and insights to get started.

Is there a claim time limit?

Here's another question that our LifeDirect advisers get often asked: is there a time limit for making a claim on personal insurance (life or health cover)? Here are some key things to know.

Why talk with a LifeDirect insurance adviser?

This month, we talked with our Adviser Ben Laurenson about the many benefits of getting advice from the guys at LifeDirect. Here are his thoughts.

How to make the most of health insurance

Like to get the most out of your health cover? From quotes to claim time, and year after year, there are some key things you can do.

Couple goals: tips for having the 'insurance talk'

Are you in a couple and looking for ways to protect the life you're building together? It all starts with an open, honest conversation.

Why Public Trust

Public Trust provides a wide range of services designed to support you and your whanau by providing security and peace of mind. Whether you're starting out, starting again, or winding down, our specialist experts are here to help throughout every stage of life.

Winter hacks you probably didn't know about

Winter is here! Time to cozy up with a good book, your favourite TV show – or why not, this selection of winter hacks to make it through the cold season. We combed the Internet for some of the most unusual life hacks we could find – enjoy the read!

The amazing benefits of gardening

Whether you're a plant wizard or just starting out, here are some science-backed reasons to give your 'green thumb' a good workout all year round.

Covid and your cover (old and new)

Wondering what Covid means for your existing or new insurance policy? Here are a couple of important things to know about Covid-19 and your cover.

Public Trust Free Will Promotion Terms and Conditions

Right now, you can get a FREE online Basic or Standard will when you take out any insurance policy with LifeDirect. Or if your needs are more unique, a Comprehensive will costs just $40.00, plus receive a further 20% off additional products online.

How LifeDirect advisers can make 'claim time' easier

Insurance is something you get and hope you never need. But if 'claim time' comes around, it can make all the difference. So, we asked our expert insurance advisor Ben Laurenson to share his top claim-time tips, and how LifeDirect advisers can help you make the most of your cover.

Stepped or level premiums: what's the difference?

Most people know that insurance costs increase with age, and that's true for the most common type of premium: stepped (age-related) premiums. However, if you plan to keep the same level of life insurance that you have now until you're 60 and over, there's another type of premium to consider - level premiums.

Inflation, rates and more: 2022 and your cover

There's never a dull moment in the economy, but 2022 has been a particularly big year on that front. Looking for tips to manage your cover in times of increasing costs? Here are some helpful insights from Senior LifeDirect Adviser, Ben Hindin.

Essential checks for your health 'warrant of fitness'

As the saying goes, prevention is the best medicine. But as we know all too well, when life gets busy, it can be easy to overlook your own health.

Five things to know about your health cover

If you've had your health insurance for a while, now may be a good time for a recap of how it all works. So, here's health insurance in a nutshell.

What we've learned about remote work

With remote/hybrid work becoming the norm for many workplaces, we've all learned a lot about working remotely since the pandemic started. So, we put together some first-hand tips from our team at LifeDirect, on how to make working remotely work for you.

Inflation, rates and more: 2022 and your cover

There's never a dull moment in the economy, but 2022 has been a particularly big year on that front. Looking for tips to manage your cover in times of increasing costs? Here are some helpful insights from Senior LifeDirect Adviser, Ben Hindin.

Essential checks for your health 'warrant of fitness'

As the saying goes, prevention is the best medicine. But as we know all too well, when life gets busy, it can be easy to overlook your own health.

Five things to know about your health cover

If you've had your health insurance for a while, now may be a good time for a recap of how it all works. So, here's health insurance in a nutshell.

What we've learned about remote work

With remote/hybrid work becoming the norm for many workplaces, we've all learned a lot about working remotely since the pandemic started. So, we put together some first-hand tips from our team at LifeDirect, on how to make working remotely work for you.

Personal insurance when you're self-employed

Are you about to start your own business or go freelance? Or maybe you already own your business and now you're exploring your insurance options? Helping you protect your financial future is, well, our business. So, here are some personal cover types to consider when you're self-employed.

How to add years to your life

For centuries, people have been in search of a 'fountain of youth'. And even now that our life expectancy is increasing day by day, we certainly wouldn't mind adding a few more years to our lifespan. So, what if that legendary fountain wasn't a fountain at all? Here are some great tips and insights from New Zealand insurers, to help you enjoy a longer life.

Personal insurance when you're over 50

Are you over 50 years old and exploring your insurance options? Now is a great time to bask in the financial security you've been working to create, and make sure you're on a comfortable path to retirement. Here's how different types of cover can help you protect your future.

Applying for new cover? If in doubt, disclose

When you apply for new cover, you need to answer a number of questions about your medical history and current health. And there's a good reason for this.

Fitting exercise into your busy schedule

Looking for ways to stay fit but don't have a lot of time to spare? We hear you — there are only so many hours in a day to get everything we need done. And motivation and time management are often two of the biggest obstacles to fitness.

Health insurance benefits you may not know about

With people's health taking a front seat in recent years, more and more insurers are focusing on supporting Kiwis' wellbeing from multiple angles. And depending on your health insurance policy, your policy may cover a lot more than just specialist visits, or surgery.

Rising mortgage rates: is your cover up-to-date?

If you own a mortgaged home, you probably already know this: after years of mortgage rates heading south, the trend is now upwards. Those on a floating rate have already felt it, and for many other home owners, it's only a matter of time before fixed-rate expiry dates start rolling in, bringing higher repayment amounts.

DHB surgery backlog: How to get faster access to care

In New Zealand, we're certainly lucky to rely on low-cost access to public healthcare, especially when it comes to emergencies. But when it comes to non-urgent care, access to treatment often involves long waits — and the pandemic has exacerbated this issue.

A New Year checklist for your insurance

Is it time to review your cover? The turn of a calendar year can be a good time to assess what you already have and what you need going forward — especially if things have changed in your life of late.

How insurance helps achieve peace of mind

Financial, personal and mental wellbeing - they're all interconnected. And one can argue that there's never been a time like this to take care of your overall wellbeing. So, how does insurance help? Here are some facts, stats and tips for you.

Common KiwiSaver mistakes to avoid

Are you invested in KiwiSaver and looking at making the most of it? As straightforward and seemingly low-maintenance as KiwiSaver is, there are some key things to watch out along the way.

Slip, slop, slap - and other sun smarts

Sun damage can be prevented, if you know how. So we've combed insurance providers' websites for some sun smarts, to help you beat the rays and stay safe.

Why not get insurance advice?

Insurance is a one-of-a-kind solution. People take out cover in the hope they'll never use it, and in the meantime, what they get in return is invaluable peace of mind. It's not something anyone likes to think about; but it's also something that can benefit anyone, in times of need.

Why get income protection insurance when we have ACC?

Many people in New Zealand tend to overlook income protection insurance, thinking ACC would step in anyway if they were unable to work. So, to cut through the confusion and help you best protect your financial future, here are some key things to know.

Seven steps to a happier you

To help you make mental health a priority for the rest of the year and beyond, we've collated some great tips from NZ's top insurers.

A day in the life of a good sleeper

We all know how vital a good night's sleep is: there are simply too many health benefits to mention. Sure, some people are born sleepers - (pun alert!) they can do it with their eyes closed. Others, though, not so much.

Getting cover for non-Pharmac medical treatments

Insurance is all about having flexibility and choice, and when it comes to taking care of your health, there's no such thing as "too many treatment options".

Thinking of switching or upgrading your cover?

With new solutions and promotions coming up all the time, there can be many good reasons to replace or upgrade your insurance; however knowing the potential downsides is also key.

Pre-existing condition(s)? Yes, insurance may still be possible

Looking for new cover? If you have a pre-existing medical condition, you may be wondering how it may affect your new insurance application

Trauma insurance and health insurance: Does it help to have both?

On the surface, health and trauma insurance have the same purpose: to provide much-needed financial support if you fall seriously ill. But if you look under the hood, you'll find that they're quite different, and depending on your needs they can actually complement one another.

Saving for a home? How to protect your homeownership dream

Insurance - it's not just for the milestones you've already achieved; it's also the sometimes-winding journey it takes to get there. Is homeownership on your wish list, for example? With rising prices across New Zealand, buying a first home has never been more challenging, and unfortunately, it's not getting any easier.

Five steps to winter wellness

The cold season is here, which means shorter days, cooler nights, and perhaps waning motivation. But before you go into 'hibernation mode', we collated some handy winter wellness tips from some of New Zealand's top insurers - to help you kick your immune system into gear and chase away the winter blues.

When and why do I need to review my cover?

When was the last time you reviewed your cover? Many things can change in life, and sometimes, these changes happen very quickly. Whether it's a big milestone or something seemingly small, each life event can affect your finances, your goals, and insurance needs.

I'm young: Why would I take out health insurance?

As a young person, you're probably living in the now. The future is looming on the horizon, a kaleidoscope of seemingly endless possibilities and unique experiences, but perhaps you don't think too much about it as yet. And that's only natural. But what if we told you that health insurance is a gift you can give to 'future you'?

How to keep your life insurance affordable - for life

Affordability, both in the short and longer term, is a key consideration when it comes to life insurance. As you know, insurance premiums usually increase with age. They generally start at their lowest levels when you're young and then, year after year, as you age and the likelihood of claiming increase, they keep rising. But what if we told you that there's a way to fix your life insurance premiums - for life? Let us introduce you to another type of premium...

Do you know what you can claim?

Claim time can be a stressful time for anyone, but it's also when the value of having insurance really comes to life. So here are some pointers to help you make the most of your cover - by knowing when to claim on it.

Have you "outgrown" your insurance?

"Change is the only constant in life" - you've probably heard this quote before. And if you're in the second half of life, chances are you've already experienced some of life's biggest changes. Children grow up and become independent, the amount you owe on your mortgage shrinks, and your last day of work gets closer.

Insurer overview

Check out our trusted insurers

Frequently asked questions

Some frequently asked questions about trauma insurance

QuickCover Life Insurance Policy

QuickCover is a straight forward life insurance policy that pays out a lump sum on your death or if you are diagnosed with a terminal illness (terminal illness is defined as a condition that is expected to cause death within 12 months). There are no expensive frills - just simple cover that's easy to arrange.

How to (truly) relax and unwind this holiday season

We hope you get to enjoy some quality time with your loved ones and friends over the holidays - you deserve it. And here are some tips to help you recharge your batteries for next year.

Top tips to stay healthy during the festive season

'Tis the season to be festive, and fed. Here are some expert tips* on how to stay healthy during the festive season - to help you enjoy the celebrations, guilt-free.

Why you're never too young or too old for insurance

Whether you're a 25-year-old just starting out or a 55-plus-year-old nearing retirement, you're never too young or too old to take out cover. Here are some key things to consider.

Four New Year's resolutions that can reduce your insurance premiums

New year, new you? This time of year is traditionally a moment for reflection - new beginnings, new directions, new goals. So if you're thinking about the changes you'd like to make, read on...

Health insurance for 50-plus

Some may say that life begins at 50. It's when you're most likely to reap the fruits of your hard work. A big part of your mortgage may be paid off. And if you have kids, they might be achieving their own financial independence.

What's the difference between Life and Health Insurance?

On the surface, it's a bit like comparing apples and turnips. Life insurance is designed to provide a lump sum to secure your family's wealth and lifestyle if you're no longer around.

Trauma Insurance: Over $110 million paid to Kiwis in just 6 months

Thinking about critical illnesses or injuries certainly isn't pleasant, but unfortunately, the unexpected can (and does) happen.

Protecting your biggest asset with Income Protection

First thing first, right off the bat: What's your biggest asset? Many people would say their house, their business, or their car. The reality is all these items depend on an even bigger asset: your ability to earn an income.

Pandemic Life Insurance: Key things to know

Have recent events prompted you to think about protecting yourself and your financial future from the potential impact of Covid-19? Whether you already have cover or are exploring your options for the first time, here are some key things to know.

Health insurance through the life stages

Young and single or retiree? Is your family growing - or are your children flying the nest? Health insurance can give you faster access to private healthcare at any stages of life.

Do you need life insurance to buy a house?

Short answer: No, you don't need life insurance to buy a house - but as a homeowner, life insurance is a very good idea. If you're hunting for your first home, here are some key things to know.

SmartCare+

SmartCare+ is Accuro's top rated individual product for those who make their health a priority. The SmartCare range has been recommended by consumer experts for best product and price as well as highest customer satisfaction since its launch in 2008.

Insurance Jargon Buster

Insurance can be tricky - we get that, especially with all the jargon. We're here to help ensure you have the information you need to make an informed choice about what insurance is right for you.

How do different options affect your life insurance premium?

We know life insurance can be overwhelming, there's so many different options that can have a material impact on your premium, so we're here to make it as easy as possible for you.

Put your health first with nib

At nib, we know that life can be unpredictable. That's why our health insurance is designed to be easy to use, affordable, and flexible so you get cover that suits your needs. Our aim is to support you with insurance claims while also being a true partner on your health journey.

Fidelity Life

For today. For tomorrow. For life. At Fidelity Life we're proud to be the largest New Zealand owned and operated life insurer.

New Zealand's best little health insurer

Accuro is a New Zealand-owned, not for profit insurer. We put our 30,000 members before financial gain.

UltraCare

UltraCare is a premium surgical and healthcare plan for those who want the highest level of cover.

Southern Cross

We're working towards a healthier New Zealand, empowering all Kiwis to live healthier lives.

Premium Cover

Premium Cover is an insurance that pays your total insurance premiums if you are disabled and unable to work.

Complete Disablement Cover

Complete Disablement Cover is an insurance that pays you a lump sum amount if you become completely disabled due to illness or injury.

Life & Life Income Cover

Life Cover is an insurance that pays you a lump sum if you die or are diagnosed with a terminal illness. Life Income Cover pays a monthly benefit for a period of time.

Chubb Life

Chubb Life New Zealand is a leading specialist provider of life insurance, funeral insurance, income protection insurance, trauma insurance and travel insurance products and services.

Partners Life

Life won't give you warning when it's over. Are you covered?

Total and Permanent Disablement Insurance

This insurance provides a lump sum of money to make life a little easier if you become totally and permanently disabled.

Workability Insurance

Workability Insurance will help you to get back on your feet and earning again, if you're unable to work due to sickness or injury.

Cancer Insurance

Although it remains one of the most common and devastating diseases – cancer isn't a death sentence by any means.

Accidental Death Insurance

This is quite a specific insurance for death as a direct result of an accident. Not exactly cheery stuff, but the lump sum can come in handy.

Mortgage and Living Insurance

A comfortable lifestyle is the result of hard work, it makes sense to protect it right?

Income Protection Insurance

This insurance is simple, but powerful. As the name suggests, Income Protection protects a percentage of the money you normally earn.

Trauma Insurance

Recovering from a serious illness, injury or medical procedure takes time. Our Trauma Recovery Insurance provides you with a lump sum payment to help financially while you recover.

Life Insurance

You can't predict the future, but you can help protect yourself against it. Life Insurance can provide a lump sum of money if you die or become terminally ill.

Because you only live once

Life's full of ups and downs. And most of us wouldn't have it any other way. If things don't go to plan though, that's where insurance can really help.

AIA Total Permanent Disablement Insurance

With Total Permanent Disablement (TPD) Insurance you will get a lump-sum payment which can assist with your mortgage, covering medical expenses, modifications to your home or other bills

AIA Living Progressive Care

AIA Living Progressive Care is an innovative trauma insurance that allows you to make multiple claims, based on the severity of your illness or injury.

AIA Living Accidental Death

AIA Living Accidental Death is a very basic type of life insurance that simply provides a lump sum should you die as a result of an accident.

AIA Living Family Protection

AIA Living Family Protection is designed to minimise the impact on lifestyle after your death through a monthly payment to your family, rather than a lump sum.

Why AIA?

We know real life can be unpredictable. With our strong financial foundation and innovative insurance solutions, we're here to partner with you through life's up's and down's.

What is the life insurance underwriting process?

The life insurance underwriting process helps insurers calculate risk.

About AIA Vitality

AIA Vitality is an award-winning health and wellbeing program.

What is income protection?

Income protection insurance cover enables you to protect your income.

What is an income protection waiting period?

When setting up your income protection, you`ll need to choose a waiting and payment period.

What is mortgage protection insurance?

Mortgage protection insurance is a flexible, low cost way to make sure you don’t lose your home

Does vaping affect your insurance?

Most insurance companies view cigarettes and vaping devices as the same.

Mortgage and income protection

Both insurance products are designed to pay you a series of ongoing payments

Will New Zealand health insurance work in Australia?

Some insurance companies offer health cover in both New Zealand and Australia.

Does smoking affect insurance?

Smokers generally face higher insurance premiums than non-smokers

Insurance company financial strength ratings

A financial strength rating expresses an insurers opinion to meet its financial obligations

What is a health insurance exclusion?

Depending on your medical history you may find an exclusion on your insurance.

Does health insurance work overseas?

New Zealand health insurance cover won`t protect you.

What is a health insurance excess?

Your excess amount is the part of your claim that you agree to pay.

Health insurance claim limits

These limits are the maximum your insurer will pay if you were to claim on a surgery.

Frequently asked questions

Some frequently asked questions about health insurance

Insurer overview

Check out our trusted insurers

Health insurance for kids

Health insurance for children is an easy way to safeguard their future.

Health insurance for a pre existing condition

Your medical history may affect what you can get health insurance cover for.

Terminal illness and life insurance cover

A good life insurance policy will pay you a lump sum amount if you get diagnosed with a terminal illness.

Who owns a life insurance policy?

The role of the owner of a life insurance policy is simple.

Kiwi home buyers' guide to life insurance

Buying a property is likely to be your biggest ever purchase.

What is health insurance?

Health insurance is a way to avoid public waiting lists, and access top medical care when you need it.

When do you need life insurance?

You should review your cover every few years, particularly after major life events.

Your BMI and life insurance

Your body mass index (BMI) is an important factor when applying for life insurance.

Kiwi new parents guide to life insurance

Some of your most important decisions will be about making sure you can financially care for your child.

Insurer overview

Check out our trusted insurers

How much life insurance do you need?

Knowing how much life insurance you need is essential.

What is level life insurance and how does it work?

There are two types of life insurance cover you can apply for.

What is trauma insurance cover?

Trauma cover provides you with a lump sum payment if you are diagnosed with a critical illness or injury.

Insurer overview

Check out our trusted insurers

Insurer overview

Check out our trusted insurers

What is life insurance?

Life insurance cover gives you the ultimate peace of mind knowing your family members and loved ones are looked after.

Frequently asked questions

Some frequently asked questions about life insurance

Frequently asked questions

Some frequently asked questions about mortgage insurance

Frequently asked questions

Some frequently asked questions about income protection